A political standoff between the United States and Canada is now sending tremors through the beverage industry. In response to American trade tariffs, several Canadian provinces have delisted US-made spirits from their liquor store shelves. But the impact of this boycott is not confined to American brands. It’s triggering a broader decline in alcohol sales across Canada, hurting domestic producers and reshaping consumer behaviour.

Multiple reports, including those from Financial Post, Reuters, and Bloomberg Law, reveal that what began as a targeted retaliation has quickly spiralled into a market-wide contraction. The implications are serious for beverage stakeholders on both sides of the border.

A Ripple Effect No One Wanted

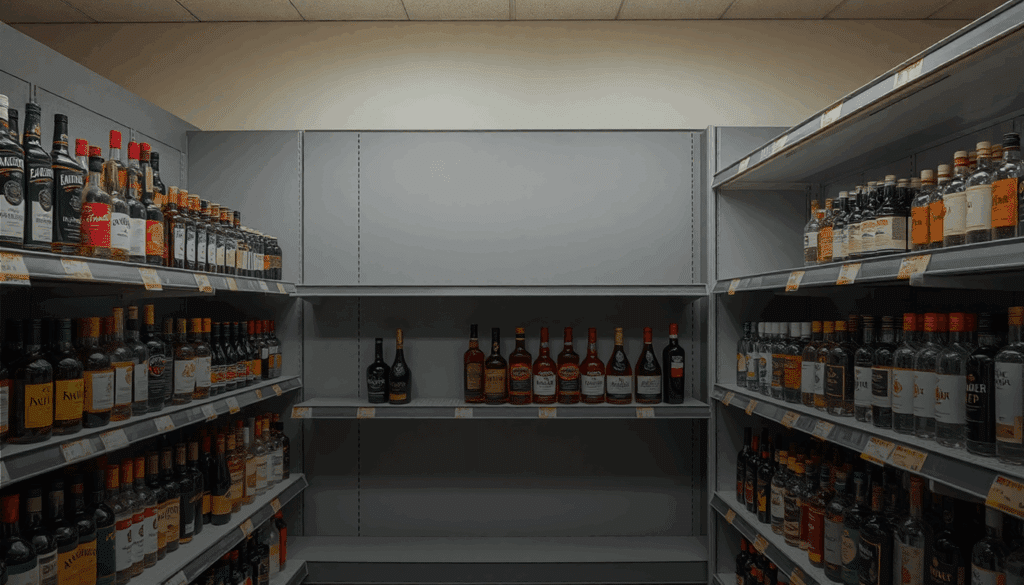

Since March 5, when the boycott measures took hold, sales of US spirits in Canada have plunged by over 66 percent. In Ontario, the country’s largest provincial market, sales dropped by a staggering 80 percent after American products were removed. But Canadian brands aren’t reaping the benefits. Spirits Canada reports that domestic spirit sales have fallen by 6.3 percent, while other imported labels dropped by 8.2 percent.

Rather than switching loyalties, Canadian consumers are increasingly walking away from liquor stores altogether. Total spirits sales across the country declined nearly 13 percent by the end of April. Year-over-year, the entire spirits category has contracted 3.3 percent, down to $405.5 million, according to Financial Post.

The boycott’s effect extends beyond the aisles. A Bank of Canada survey revealed that more than 60 percent of Canadian households are now consciously spending less on US-made goods, pointing to a broader shift driven by nationalist sentiment. Meanwhile, US President Donald Trump’s renewed tariff threats, including a proposed 35 percent duty on Canadian goods starting in August, risk inflaming the situation further.

A Cross-Border Blow to Spirits Producers

What’s unfolding is more than a temporary dip in sales. The North American spirits industry operates within a highly integrated ecosystem. According to Spirits Canada CEO Cal Bricker, the immediate and ongoing removal of American products from shelves is deeply problematic for producers in both nations. This is not just a political tit-for-tat but a disruption with commercial and operational consequences.

Even though Canada may represent a small share of annual sales for some major American brands, such as Jack Daniel’s producer Brown-Forman, the loss of visibility and market momentum cannot be ignored. For smaller or mid-sized producers, the impact could be far more severe, especially in a market where government controls much of the distribution and retail network.

What Comes Next for Beverage Brands

As tensions rise and consumers adopt a more cautious or politicised approach to spending, beverage businesses must act strategically. This dispute serves as a reminder of the delicate balance between policy, consumer behaviour, and industry health. Brands should be preparing for prolonged instability by exploring new market segments, reinforcing brand loyalty at home, and advocating for swift diplomatic resolution.

For now, producers and marketers across North America would be wise to monitor these developments closely. This is more than a tariff row. It is a test of resilience for an interconnected industry navigating a climate where politics can shape the shelf space.